As part of Black History Month, 1st Priority Mortgage is taking a look at the historical barriers that have made it harder for Black Americans to purchase a home. It’s no secret that there’s a wealth gap in the U.S., but did you know that the homeownership rates for Black Americans is 30 points lower than their white counterparts? That’s a huge gap, and it has long-term consequences for Black families since homeownership is one of the best ways to build generational wealth.

To better understand where we are today, we’re exploring the discriminatory housing policies that created these disparities.

A Legacy of Discrimination

Following a wave of foreclosures during the Great Depression, the Federal Housing Authority (FHA) began offering government-insured mortgages to prop up the housing industry and encourage homeownership. Unfortunately, the agency also created a set of criteria that disqualified Black homebuyers from participating in the program.

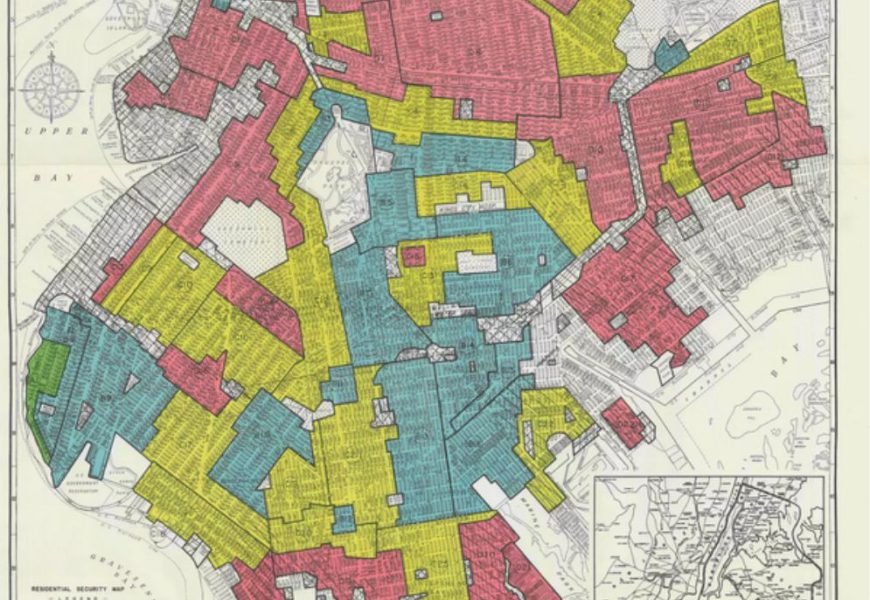

The agency used a set of color-coded maps to identify neighborhoods that were loan-worthy and could qualify for a mortgage. The maps were used in 200 cities across the U.S. and ranked each neighborhood from “A” to “D” based on their creditworthiness. The “A” regions were the most creditworthy, while “D” neighborhoods were considered not worthy of a loan.

Across the country, neighborhoods made up of predominantly Black residents were given a “D” rating, which disqualified them from the program. This practice, also called “redlining” because “D” neighborhoods were coded red, prevented Black Americans from accessing crucial loan programs that white families could easily access.

Redlining continued well into the 40s, 50s and 60s, giving white families who qualified for government loans three decades’ worth of equity appreciation that Black Americans did not gain.

The Fair Housing Act

In 1968, the U.S. passed the Fair Housing Act which made the practice of redlining illegal. The law was intended as a follow-up to the Civil Rights Act of 1964 and prohibited discrimination in housing based on race, religion, national origin or sex. When passed, it was meant to eliminate overt discrimination and disparities in the housing market.

While the law changed in 1968, the decades’ worth of wealth accumulated by white families who qualified for FHA mortgages provided them with financial advantages that lasted for generations. For decades after the bill’s passage, white developers and homeowners also ensured that traditionally Black neighborhoods remained segregated and devalued by refusing to sell or rent to Black families.

Looking to the Future

It’s important to note that redlining was not the sole cause of the racial wealth gap in America. There have been a wide range of other policies and systems that have created the housing disparities we face today. Redlining is just one of many dark and lasting forces in the housing industry.

As 1st Priority Mortgage and the Hanna Family of Companies look toward the future, we remain committed to ensuring fair and equitable housing opportunities for all of our clients. In fact, earlier this year, the Hanna Family of Companies launched United Purpose Mortgage (UPM), a new mortgage company dedicated to equitable lending practices.

UPM has a mission to support homebuyers who may have been overlooked by the mortgage industry. The new company offers a range of financial education resources to help support new buyers and provide lending credits to help borrowers put together a downpayment.

The mortgage and housing industries have a long history of discrimination, but 1st Priority Mortgage and UPM are committed to creating a more equitable tomorrow. To learn more about UPM’s mortgage programs, click here.